Residential Conveyancing remains the single largest source of claims under the Master Policy. And in recent years, it has also represented the single largest share of the total cost of claims.

In 2011/12, when Master Policy claims notifications peaked following the economic downturn, residential property claims alone cost the Master Policy over £11million.

Since then, the number of residential property claims has more than halved, but there are reasons for caution.

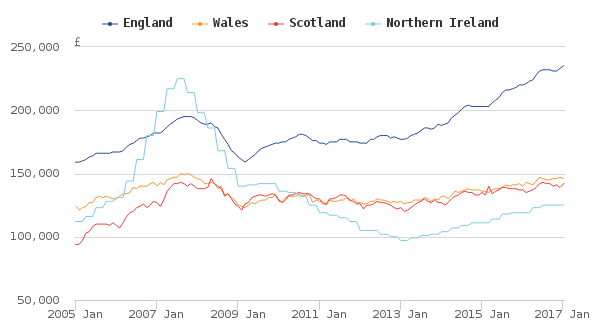

- there has been a trend for significant numbers of property claims to triggered at periodic intervals, usually in tandem with a fall in property values

- the UK property market continues to demonstrate a 'boom and bust' tendency

- there has been a considerable increase in sub-prime mortage lending following the effective closure of this market post 2008

- average property values in Scotland have now returned to their 2007 levels, and in some 'hot spots' are well in excess of the 2007 high (see the mapping of UK house prices below)

- while claim numbers are currently down, the quantum of claims has continued to rise.

Average UK House Prices

(Source: HM Land Registry, Registers of Scotland, Land and Property Services Northern Ireland and Office for National Statistics)

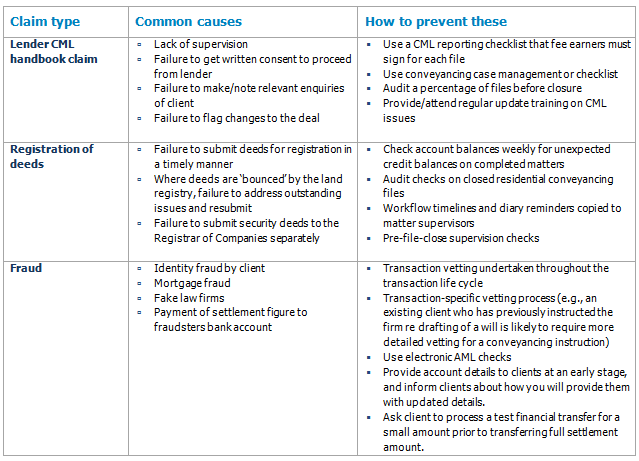

Main Causes of Claims

-

Lender Claims - CML Handbook

-

Registration of Deeds

-

Fraud

-

Drafting errors

-

Due diligence errors (boundaries, servitude rights)

Lender CML-related claims continue to produce twice as many claims as any other residential property-related claim type. While other causes of claim have fallen, fraud-related claims have been rising. Indentity fraud remains a problem area in residential property, along with Mortgage fraud, and frauds involving interception of emails, resulting in the payment of settlement dues to a fraudster.

Summary of risks, common causes, and risk mitigations